Market Update Summary - Dec 15

Abstract

The crypto macro landscape saw further structural tailwinds this week, with XRP’s expansion across Solana, Ethereum and major L1s boosting cross-chain liquidity access. The IMF’s brought renewed focus on stablecoin risks underscores rising regulatory attention on global payments. Stripe’s launch of the Tempo testnet further accelerates institutional infrastructure, signaling that fintech and TradFi players are moving into real blockchain deployment.

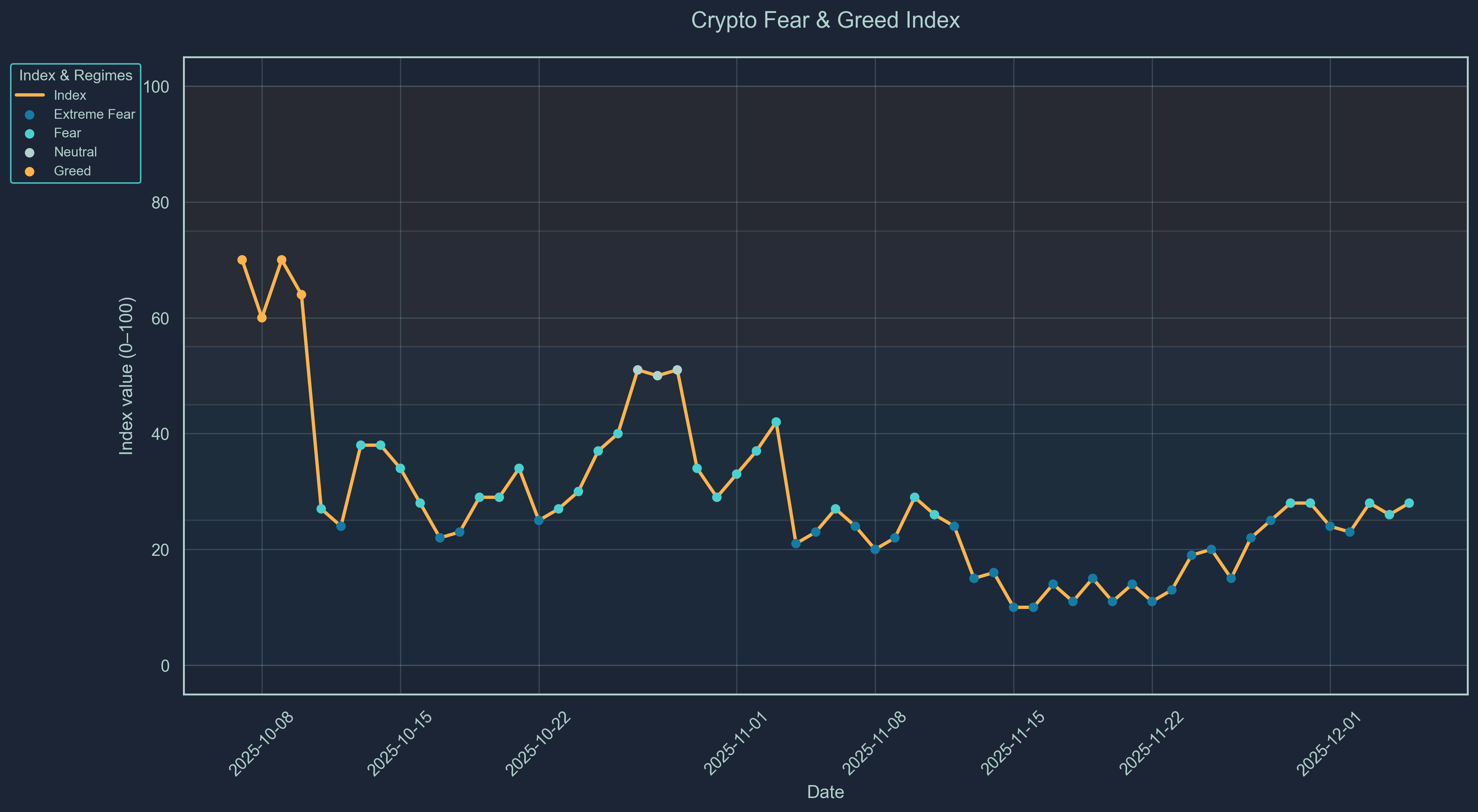

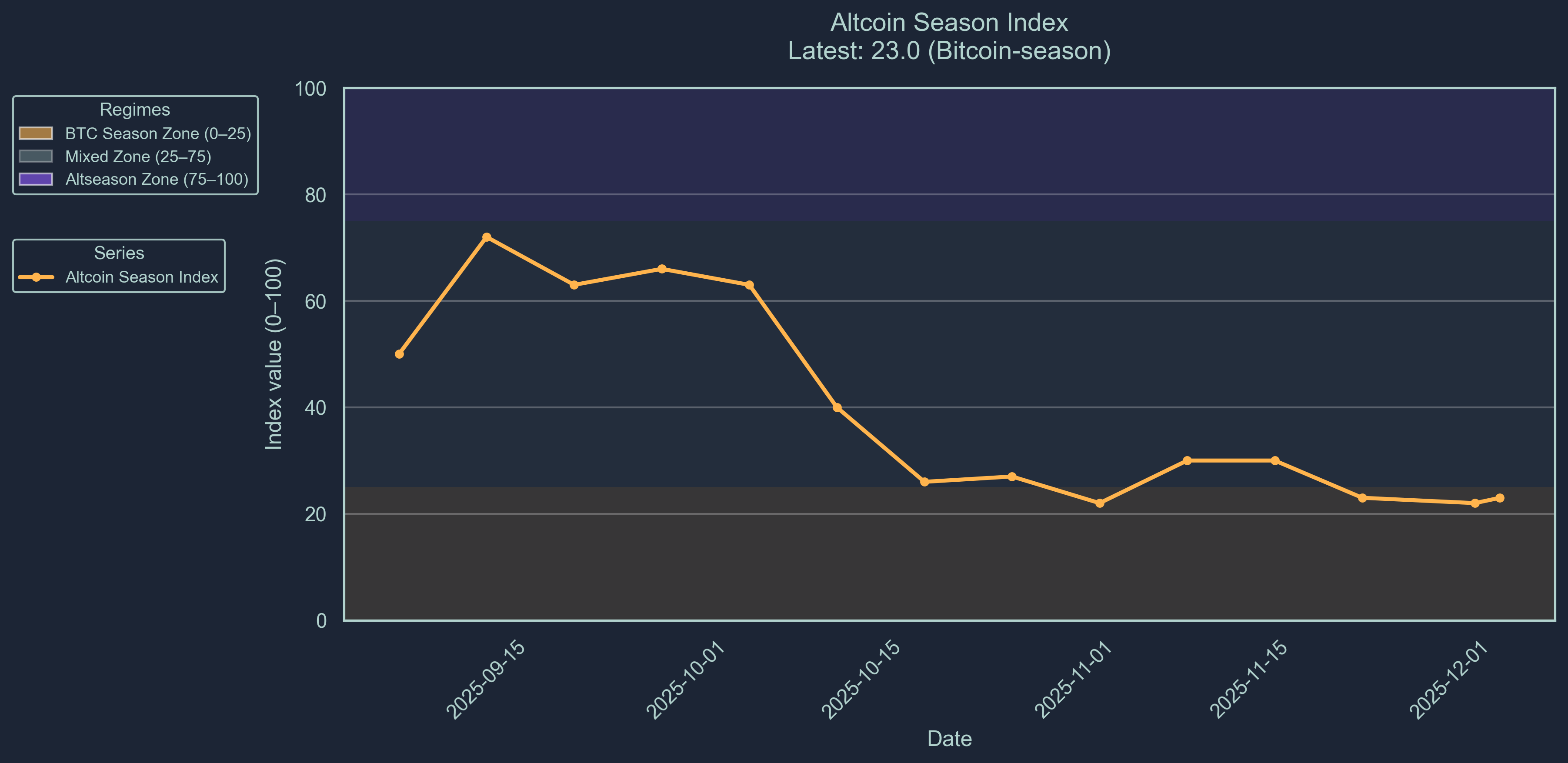

Market sentiment, however, remains cautious. The Fear-and-Greed index sits at 28, and the altseason indicator dropped to 18, confirming deep Bitcoin season as capital rotates defensively.

Bitcoin trades at $92.7K, Ethereum shows resilience at $3,259, while Solana remains the weakest major asset at $137.

Smart money flows reflect risk aversion: inflows concentrated into selective high-conviction projects like BGB, MORPHO, and MOODENG, whereas outflows hit larger ecosystems including G, JUP, WLD, and EIGEN.

Overall positioning remains defensive, with stablecoin flows indicating sidelined liquidity awaiting clearer market direction despite improving structural and regulatory signals.

Market Sentiment

Market sentiment has remained fearful, with our Crypto Fear-and-Greed index sitting at 28 (Scale 0-100). We indicate that the market remains undervalued with investors being fearful of volatile assets.

Market sentiment has declined further into BTC season this past week, with the altseason indicator dropping at 18.0 (Scale 0-100). This score represents that only 24% of altcoins included in the Top-100 index outperformed Bitcoin over the previous 90 days. Bitcoin season is interpreted as a bearish signal in the market.

Major Token Performance Performance

How to Read These Charts

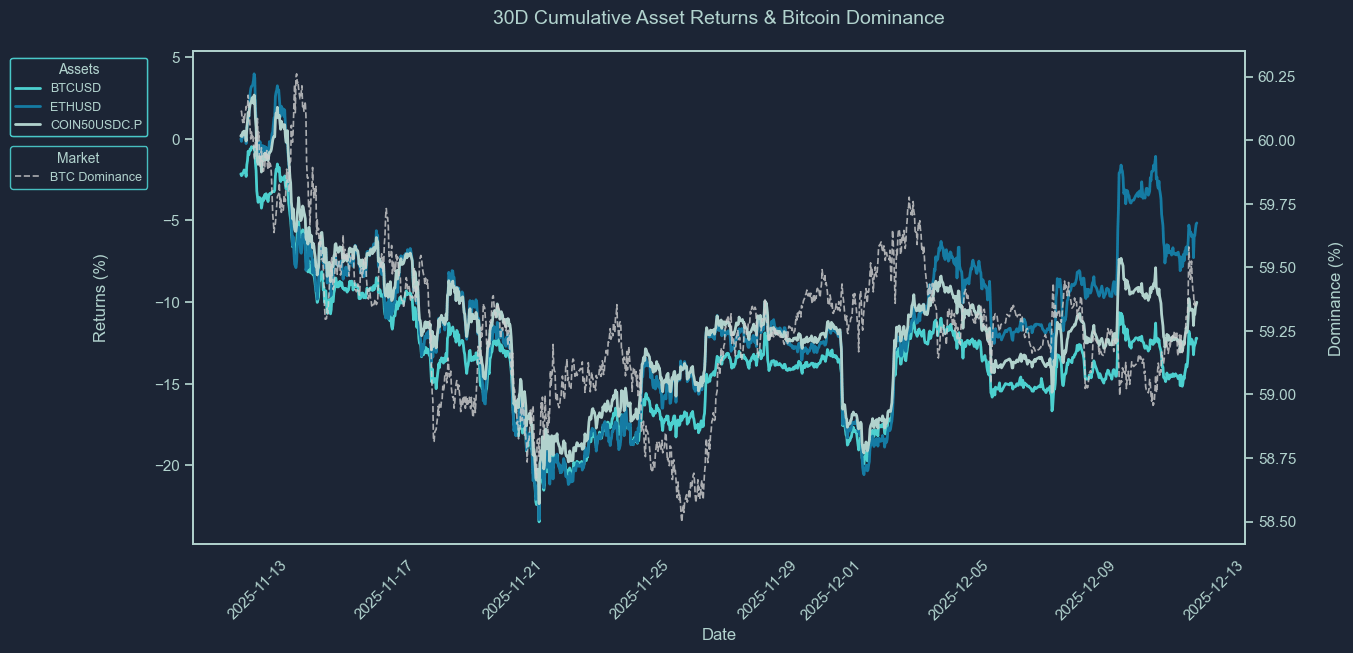

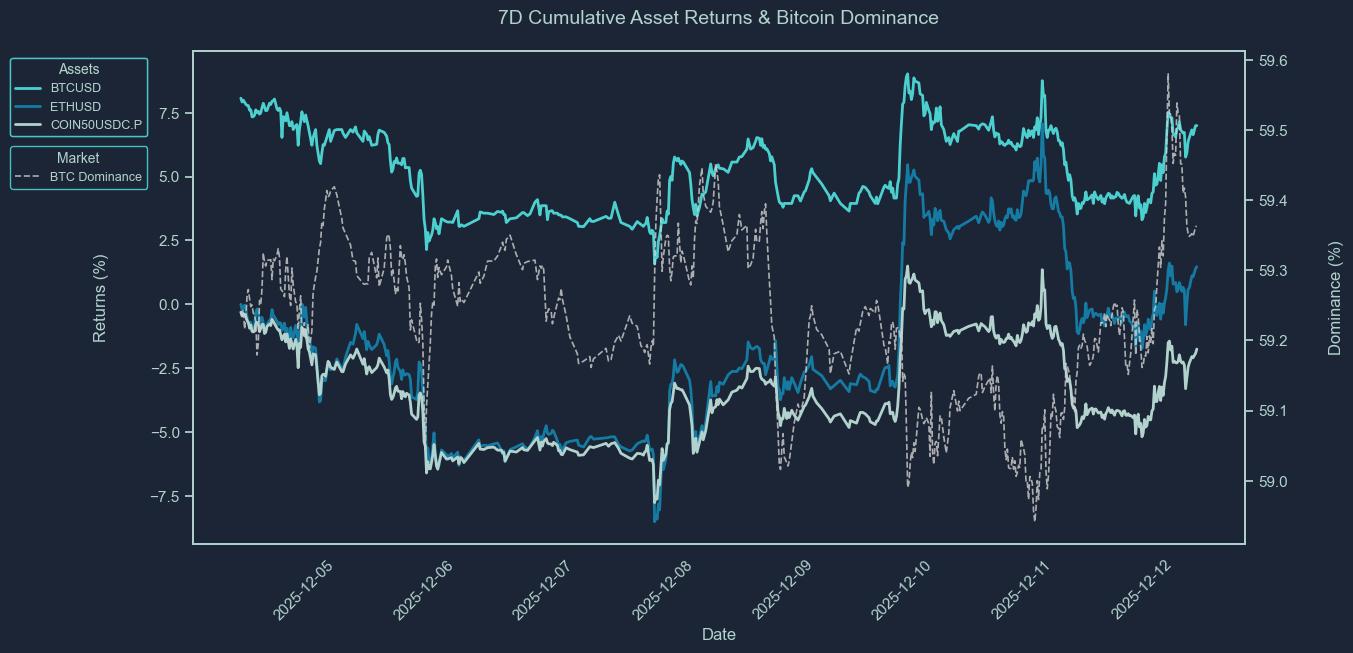

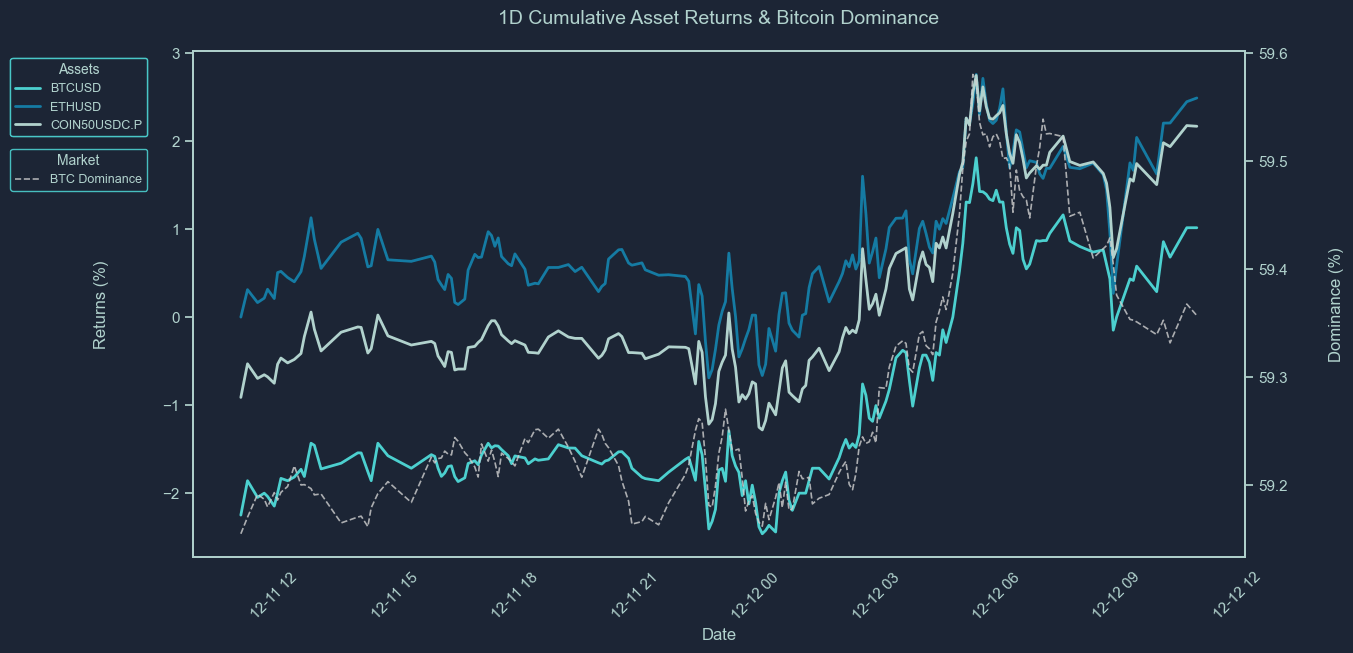

These charts show the cumulative price returns of Bitcoin (BTC), Ethereum ETH), and the COIN50 index over the selected periods; 30 days, 7 days or 24 hours. Returns are rebased to 0% at the start of each period to highlight relative performance trends between assets.

The BTC dominance line (secondary axis) tracks Bitcoin’s share of the total crypto market capitalization, offering context on capital rotation between BTC and altcoins. Rising BTC dominance typically indicates capital consolidation into Bitcoin, while a decline suggests increased risk appetite and flows into altcoins.

Use these charts to quickly assess:

Which assets outperformed or underperformed over the period

Whether market strength was concentrated (BTC-led) or broad-based

How shifts in BTC dominance align with overall performance trends

Asset | 30D Change | 7D Change | 1D Change | Price |

BTCUSD | -12.21% | 7.00% | 1.02% | 92,668.26 |

ETHUSD | -5.16% | 1.47% | 2.49% | 3259.46 |

XRPUSD | -14.83% | -7.00% | 2.22% | 2.0405 |

BNBUSD | -6.86% | -2.56% | 3.61% | 895 |

SOLUSD | -11.12% | -5.13% | 5.62% | 137.34 |

COIN50USDC.P | -10.01% | -1.75% | 2.17% | 392.79 |

XAUUSD | 3.72% | 0.88% | 0.89% | 4271.23 |

SPX | 1.08% | 1.39% | 1.04% | 6902.19 |

How to Read This Table

This table summarizes the percentage price change of key crypto and macro assets over three timeframes: 30 days, 7 days, and 24 hours. It includes major cryptocurrencies (e.g., BTC, ETH, XRP, SOL), a benchmark altcoin index (COIN50), and traditional market comparables like gold (XAU) and the S&P 500 (SPX).

The data allows you to:

Compare short-term and medium-term performance across sectors

Spot momentum leaders and laggards in both crypto and traditional markets

Assess whether market moves were broad-based or asset-specific

Track how crypto assets performed relative to macro benchmarks

This table provides a concise view of market dynamics across different asset classes and helps contextualize crypto performance within a broader macro landscape.

Newly Listed Projects

As of 2025-12-05 1:00PM

Projects and Exchanges

Project | Symbol | Exchange(s) | Listing Date |

KYO Finance | KYO | gate | 2025-12-10 |

Almanak | ALMANAK | bybit | 2025-12-11 |

Price Performance

Symbol | Opening Price | Current Price | 24 hour Change | All-Time High | All-Time Low | Current Multiple from Open | ATH Multiple from Open |

KYO | 0.3075 | $0.0998 | -44.81% | $0.4552 | $0.4552 | 0.39x | 1.48x |

ALMANAK | 0.04 | $0.0296 | -11.25% | $0.1951 | $0.0217 | 0.51x | 4.88x |

Liquidity Performance

Symbol | Spread | +2% Depth | -2% Depth | 24 Hour Volume |

KYO | 0.1% | 4,814 | 20,851 | 1,038,798 |

ALMANAK | 0.14% | 15,456 | 11,008 | 2,651,969 |

Smart Money Flows

Top 10 7D Flows

Asset | Chain | 24H Flow | 7D Flow | 30D Flow | Market Cap |

BGB | ethereum | 0.00 | 269.94K | 269.94K | 2.54B |

MORPHO | ethereum | 0.00 | 135.67K | 1.62M | 662.26M |

MOODENG | solana | 0.00 | 35.53K | 35.53K | 86.58M |

META | solana | 0.00 | 30.27K | 83.25K | 154.54M |

🌱 ZAIOS | solana | 0.00 | 22.37K | 22.37K | 255.18K |

KLED | solana | 0.00 | 20.03K | 70.50K | 23.48M |

BABY | solana | 0.00 | 17.10K | 16.24K | 1.60M |

HYDRA | ethereum | 2.00K | 14.50K | 30.50K | 341.74K |

MARS | solana | 12.45K | 12.45K | 12.45K | 387.12K |

HOPPY | ethereum | 1.38K | 7.76K | 5.32K | 7.30M |

Bottom 10 7D Flows

Asset | Chain | 24H Flow | 7D Flow | 30D Flow | Market Cap |

G | ethereum | 0.00 | -332.45K | -745.27K | 40.16M |

JUP | solana | 0.00 | -163.72K | -163.72K | 675.64M |

WLD | ethereum | 0.00 | -100.57K | -195.40K | 1.47B |

WHITEWHALE | solana | 0.00 | -72.20K | -77.64K | 1.44M |

EIGEN | ethereum | -18.33K | -67.96K | -133.19K | 230.08M |

FRANKLIN | solana | -39.22 | -49.80K | -46.09K | 11.62M |

CYBER | ethereum | -45.22K | -45.22K | -188.89K | 45.24M |

FUEL | ethereum | 0.00 | -44.23K | -46.78K | 12.06M |

FWOG | solana | 0.00 | -42.85K | 12.56K | 10.58M |

BOXABL | solana | -9.99K | -29.38K | -29.38K | 1.51M |

These tables track the weekly movement of "smart money" wallets across various tokens and chains.

The Top 10 7D Flows table highlights assets that have seen the largest net inflows from smart money in the past 7 days. A high and rising 7D flow suggests growing interest, accumulation, or conviction by sophisticated traders, and may indicate strong underlying narratives or catalysts. Compare these flows with the token’s market cap to assess relative impact, inflows into small-cap assets are generally more price-sensitive.

Conversely, the Bottom 10 7D Flows table shows tokens with the largest net outflows from smart money wallets. Persistent or large outflows may reflect profit-taking, loss-cutting, or reduced confidence, and can signal weakening sentiment or fading momentum. Watch for sustained outflows alongside declining price or on-chain activity.

Use these tables to:

Identify tokens where smart money is actively positioning

Spot emerging narratives or sentiment reversals

Gauge chain-specific flows, e.g., Solana vs. Ethereum vs. Base

Inform rotational strategies across high-alpha tokens

Stablecoin Flows

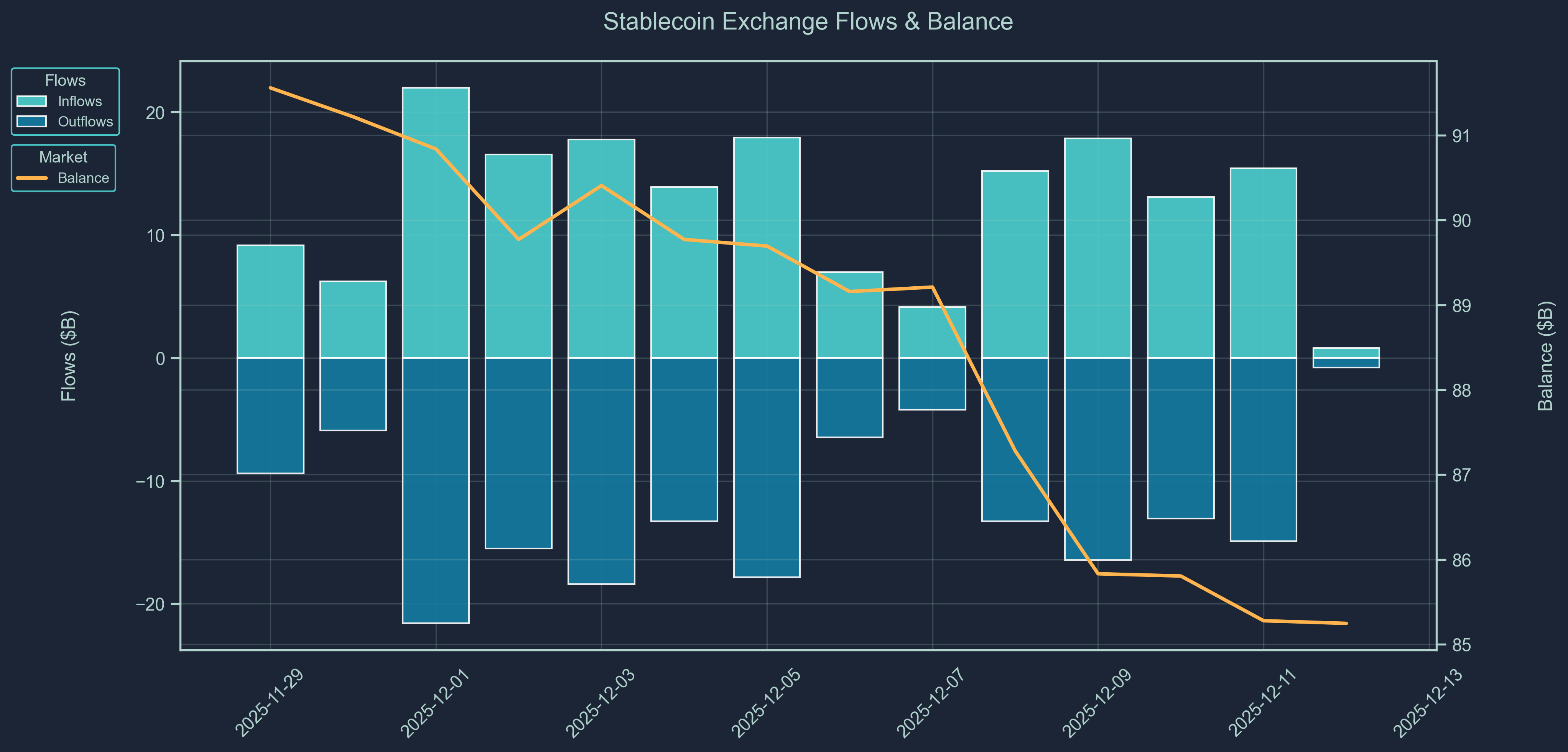

Stablecoin flow data provides a real-time pulse of capital movement across exchanges and chains.

Rising stablecoin balances on-chain or on exchanges often indicate inbound liquidity, capital sitting on the sidelines potentially awaiting deployment into crypto assets. Large inflows may precede buying activity, suggesting growing market participation or renewed confidence.

On the other hand, net outflows of stablecoins could imply that capital is either exiting the crypto ecosystem or being actively deployed into volatile tokens, especially when accompanied by declining exchange balances or stablecoin dominance.

Use stablecoin flows to:

Detect early signs of market risk appetite

Monitor capital rotation between stablecoins and volatile assets

Confirm the sustainability of rallies (is money really coming in?)

Support broader macro or positioning views from other data (e.g., smart money behavior or BTC dominance)

Macro & Crypto News

December 12: XRP Expands to Solana, Ethereum and Major L1s

XRP is now available on Solana, Ethereum, and several major Layer-1 chains, marking one of the most significant interoperability expansions in the asset’s history. The move enables wrapped XRP to plug directly into DeFi liquidity pools, lending platforms, and cross-chain trading infrastructure, dramatically increasing the token’s composability outside the XRP Ledger.

For Ripple’s ecosystem, the expansion signals a shift toward multi-chain liquidity flows and broader institutional accessibility, aligning with market trends where assets increasingly live across multiple execution environments. With Solana and Ethereum offering deep DeFi throughput, XRP’s presence on both networks strengthens its utility and addresses long-standing liquidity fragmentation. Market participants view the rollout as a step toward making XRP a more active player in multi-chain financial rails, particularly ahead of anticipated regulatory clarity for U.S. institutions.

December 10: IMF Flags Stablecoins as Emerging-Market Risk

The IMF has issued a renewed warning that USD-linked stablecoins could pose structural risks to emerging markets by accelerating capital flight and weakening monetary sovereignty. The Fund argues that stablecoins, thanks to their global liquidity and ease of cross-border use could undermine FX controls, complicate monetary policy, and increase dollarization pressures in vulnerable economies.

While analysts note that current adoption remains too small to pose systemic risk, the IMF’s tone signals a shift in macro-prudential attention toward stablecoins as global payment instruments rather than niche crypto assets. Regulators worldwide are expected to use the report as justification for tighter oversight, licensing regimes, and potential alignment with CBDC strategies. The development reinforces the trend of major institutions treating stablecoins as part of the broader macro-financial system rather than just the crypto ecosystem.

December 10: Stripe’s Tempo Testnet Launches, Targeting Institutional Payments Rails

Stripe-backed Tempo has launched its public testnet, introducing a purpose-built blockchain aimed at high-throughput stablecoin payments and enterprise settlement. Designed with predictable fees, fast finality, and bank-grade reliability, Tempo positions itself not as a trading chain but as a next-generation payments infrastructure, mirroring the rise of “specialized execution layers” in global finance.

Major partners including Mastercard, UBS and Kalshi are already involved in testing, underscoring how traditional financial institutions are increasingly moving from pilots to active blockchain integration. Tempo’s entry strengthens the narrative that stablecoin-based payments are becoming a competitive battleground between fintechs and incumbent financial rails. Its testnet debut sets the stage for a broader institutional push in 2026 as large enterprises seek regulated, programmable settlement networks.

THE CONTENT ON THIS WEBSITE IS NOT FINANCIAL ADVICE

The information provided on this website is for information purposes only and does not constitute investment advice with respect to any assets, including but not being limited to, commodities and digital assets. This website and its contents are not directed to, or intended, in any way, for distribution to or use by, any person or entity resident in any country or jurisdiction where such distribution, publication, availability or use would be contrary to local laws or regulations. Certain legal restrictions or considerations may apply to you, and you are advised to consult with your legal, tax and other professional advisors prior to contracting with us.