Designated Market Making

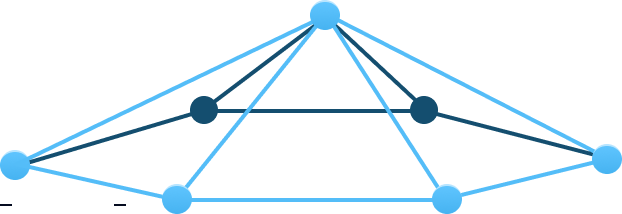

Model

Designated market making (DMM) is a contractual relationship whereby the project commits tokens and cash/equivalent assets to liquidity provision. DMM relationships are available under a monthly fee and profit share model.

Advantage

Because teams allocate risk capital to liquidity provision, they have full exposure to token upside.

Best suited for

DMM is most appropriate for projects seeking to guarantee liquidity across specified exchanges and capitalize on cyclical price movements.

Exchange coverage/liquidity KPIs

Exchange coverage and liquidity KPIs are at the sole discretion of the client.

Acheron Trading’s specificities

Through our sophisticated modeling, 24/7 availability and white glove approach, we ensure unparalleled levels of attention and results in terms of liquidity, risk management and treasury building. We also provide a dashboard so that every client can follow in real-time our liquidity metrics in full transparency.