Fundamentals: Basics of Market Making

Fundamentals: Basics of Market Making

Without an adequate go-to-market strategy, even a quality project can be left in shambles, ending the journey before it has begun. Our industry is afflicted with advisors and actors who are heavily biased, leading to misguidance, poor decision-making, and inaction. We believe that transparency should be paramount when discussing market-making partnerships. We present our findings without interference, allowing issuers, traders, and all stakeholders to draw their own conclusions.

This series, entitled "Fundamentals," will cover the basics of market making, liquidity, and price discovery, as well as the types of market makers.

The Role of Market Makers

Market makers play a pivotal role in guiding a project to market and ensuring robust liquidity conditions once public.

Pre-Market

Market makers should serve as unbiased advisors of exchange targets, providing launch strategies based primarily on a data-driven approach. They understand which exchanges, chains, and strategies typically garner the most success.

Trading

The primary role of market makers is to provide and maintain market liquidity. Through algorithmic, automated strategies, market makers deploy liquidity to target exchanges, ensuring there is always a certain degree of liquidity in the market. In its simplest form, the market maker deploys the foundational liquidity from which other participants can either take from or add to.

To bring this into perspective for non-traders, consider a busy marketplace. Market makers ensure the marketplace (exchange) is always bustling with buyers and sellers (uptime), there are enough goods for everyone (depth), and the prices of the goods are fair and competitive (spread).

During contractionary market conditions or lower-tiered markets, a market maker can provide anywhere between 60% to 100% of a token's liquidity. This is crucial for market stability, especially in situations where there might otherwise be an imbalance in the supply and demand of a particular token. Meaning, without a market maker present, the asset may be hyper volatile or outright untradable.

In expansionary conditions, on the other hand, market makers can utilize increased demand to strengthen liquidity by increasing order size and tightening spread. By doing so, the market maker improves market efficiency and provides a strong foundation for future growth.

Even on top-tier exchanges such as Coinbase and Binance, the presence of market makers is vital. While these platforms may be less reliant on market makers due to their large user base and high trading volume, market makers still play a significant role. Their constant presence in the market helps reduce transaction costs and improve overall trading efficiency by reducing price slippage and capturing arbitrage opportunities.

All in all, market makers are an integral part of any asset’s success. However, we understand that the conversations and negotiations to find the right market maker may be challenging. Market makers speak the language of liquidity. We are here to decipher what that means.

Market Liquidity and the Key Variables

Market liquidity refers to the extent to which a market allows assets to be bought and sold at fair prices. A market is considered liquid if it exhibits strong depth within key transactable ranges, and low spreads thanks to a high uptime from the market maker(s). We will delve into how these variables can impact trade inefficiencies, such as price slippage, both positively and negatively.

Depth and Price Slippage

Depth refers to the dollar amount of a token and its paired asset within key ranges. The most common ranges of discussion are typically 1%, 2%, and 10%. These ranges often correspond with the maximum amounts of slippage the average trader is willing to accept. Price slippage refers to the difference between the expected (market) price and the executed price of a trade. You can find in-depth statistics on aggregators like CoinGecko (+/- 2%) or CoinPaprika (+/- 1% & +/- 10%).

A simple thought experiment to understand market depth and price slippage is as follows. If a market has a $100 -2% depth, then a $100 market sell order would cause the market price to fall 2%. Assuming that the order sizes were (for extra precision, we add “logarithmically”) uniformly distributed throughout this range, then the price slippage of this order would be 1%. If the price was at $1, the seller would effectively receive $99 in return.

A high slippage is a market inefficiency. As a result, a market lacking sufficient depth would result in an inability to trade or in traders' reluctance to participate in a given market.

Spread and Price Slippage

The spread refers to the percentage distance between the best bid (limit buy) and the best ask (limit sell) on an order book. In relation to price slippage, spreads can be seen as an unavoidable tax you must pay to perform a market trade. Larger spreads equate to higher slippage. These statistics can be found on aggregators like CoinGecko or CoinPaprika.

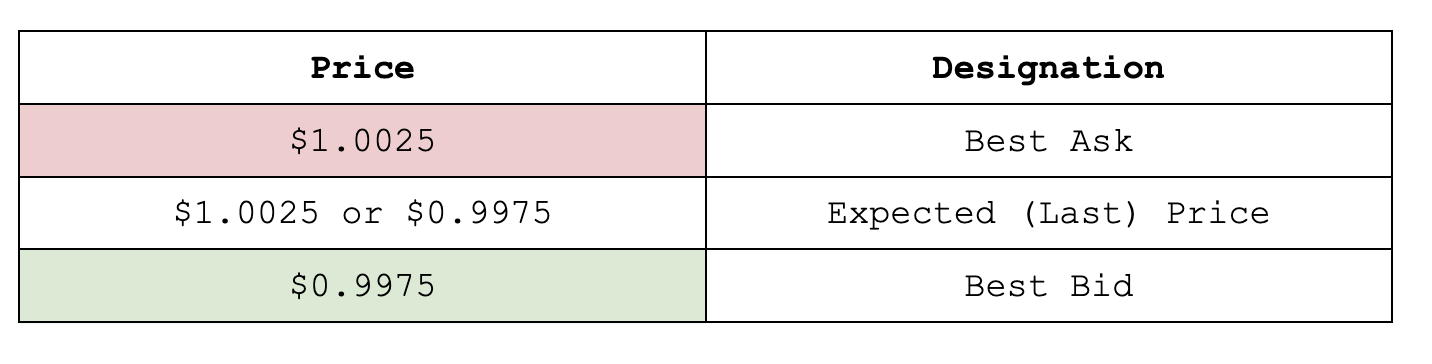

Consider the following to understand market spread. Spread equals the % difference between the best bid ($0.9975) and best ask ($1.0025). In this scenario, therefore the spread is slightly lower than 0.5% (assuming that we use the ask price - bid priceask price definition). If the spread of a market is approximately 0.5%, the minimum price slippage would be approximately 0.5% (if one had bought into the first ask and wanted to exit using the first bid or vice versa).

On centralized limit order books, the expected price is often that last traded price. Therefore, in the above example, the price may be the best ask or the best bid.

Using the scenario above, a $100 sell order with $100 in -2% liquidity and now 0.5% spread would receive $98.875 instead of the previous $99 (no spread scenario). The scenario may seem like a minor inefficiency but consider the implications at scale.

Frequent Buyers: If many users face the same slippage, there is a consistent loss for everyone buying or selling the token. As a result, users may seek alternative options to access similar utilities.

Utility Pricing Mismatch: If the token is used to purchase or access utilities such as staking services, NFTs, or settling transactions, then the cost to acquire a target amount will immediately be greater than the token’s actual value.

In other words, slippage presents an unavoidable burden that can undermine a token’s utility. Traders, therefore, favor minimal slippage as it results in lower buys or higher sells at any given time, and hence they favor lower spreads.

Uptime and Market Efficiency

Uptime, quite simply, is the percentage of total time that a market maker is online and adequately providing liquidity during your engagement. Market makers typically aim for uptime between 90 and 100 percent of the time. Common agreements tend to set uptime at 98 or 99 percent, which can help market makers avoid black swan events such as hacks or exchange failures.

Historically, hiring a market maker has been a black box agreement. Issuers often are expected to trust market makers that they are meeting key performance indicators (KPIs). Market makers may provide some or no reporting whatsoever, which has led market making brokers such as Coinwatch and Glassmarkets to enter the industry in order to hold market makers accountable.

Acheron Trading offers access to Command Station — a portal where you can view crucial market and liquidity KPIs in real-time. Hiring a liquidity broker to understand what level of liquidity your market maker is providing should not be your responsibility. Rather, market makers should be transparent.

General Liquidity

Does this mean that every issuer should want high depth, low spreads, and maximum uptime? Ideally, yes. However, dynamics such as capital risk, exchange trading fees, arbitrage risk, and more must be taken into account. This leads to a consideration of the balance between the risks and rewards of liquidity management. It is up to the issuer to find a market maker who best fits their needs. Liquidity is essential to any market, as it ensures market efficiency and inspires trading confidence.

Market Liquidity and Market Makers: Relationship to Volume

Volume generally refers to the dollar amount of transacted value in a market over a given period of time. In crypto, volumes can also be expressed in quantities of token, Bitcoin, and Ethereum. Regardless, volumes are often one of the best indicators of market and asset health.

However, volumes are not always present in cryptocurrencies. Our findings on volumes are shared here: transparency in exchange fill volumes. In summary, volumes are both cyclical and dynamic. The cyclical nature of volumes is pretty straightforward as higher interaction is observed during bullish conditions and less during bearish conditions. Volumes are also dynamic. They move from exchange to exchange, and between centralized and decentralized exchanges, based on market trends, regulatory changes, and other factors.

To be abundantly clear, market makers cannot generate volumes. To be more specific, a market maker can place limit orders that make a market more efficient, and in turn favor more interactions in the market, but a market maker itself cannot take both sides of a given trade (also known as wash trading). If a market maker claims it can generate volumes, then that is a red flag. While market makers do not directly generate volume, the absence of liquidity prevents trading altogether. Therefore by placing adequate liquidity, a market maker indirectly supports volume.

As the adage goes, "you can lead a horse to water, but you can't make him drink", the role of market makers is to set the stage for success. It is up to the traders and the market's conditions to take it from there.

Concluding Thoughts

Market makers are the invisible pillars that uphold the stability of financial markets, ensuring liquidity support, aiding in price discovery, and reducing transaction costs. They navigate the complexities of exchange targets and implement data-driven strategies that work to the advantage of issuers, traders, and other participants.

Understanding the intricacies of market liquidity, from depth and spread to uptime, is paramount to appreciating the role of market makers. These factors work hand in hand to combat market inefficiencies such as price slippage, ultimately ensuring smoother and more predictable trading conditions.

THE CONTENT ON THIS WEBSITE IS NOT FINANCIAL ADVICE

The information provided on this website is for information purposes only and does not constitute investment advice with respect to any assets, including but not being limited to, commodities and digital assets. This website and its contents are not directed to, or intended, in any way, for distribution to or use by, any person or entity resident in any country or jurisdiction where such distribution, publication, availability or use would be contrary to local laws or regulations. Certain legal restrictions or considerations may apply to you, and you are advised to consult with your legal, tax and other professional advisors prior to contracting with us.