Fundamentals: Liquidity and Price Discovery

Before We Begin

Before diving into the core of today's discussion, we highly recommend revisiting our previous article, Fundamentals: Basics of Market Making. It provides the necessary groundwork by explaining trading terminology that we will be referencing below.

Fundamentals: Liquidity and Price Discovery

Liquidity forms the backbone of any successful project. It serves as the base for an efficient and orderly price discovery. This article emphasizes the importance of market makers as indispensable entities for projects aiming to guide their assets towards favorable price discovery in the context of liquidity.

The journey of a token from inception to maturity can be broken down into four distinct phases. Each phase has unique characteristics and presents its own set of challenges.

Importance of Liquidity and Role of Market Makers

Before we delve into the intricacies of the token's journey, it's essential to comprehend the role of liquidity and the significant part a market maker plays in facilitating it. Liquidity, in the world of trading, can be viewed through various lenses: spread, depth, and uptime.

In short, the spread represents the difference between the buy (bid) and sell (ask) price of an asset. A narrower spread means less cost for traders, making the asset more attractive. Depth refers to the market's capacity to sustain larger orders without significantly impacting the price. Greater depth implies a healthier market with less price slippage. Uptime is the continuous availability of buy and sell orders, which allows for smooth and uninterrupted trading.

Market makers set these key liquidity parameters. We constantly monitor and adjust spreads, maintain order book depth, and ensure continuous uptime to facilitate efficient trading and price discovery. Additionally, our role goes beyond setting static parameters. As markets are dynamic and can change rapidly, we remain agile in our strategies, adjusting to new market conditions as they arise.

To bring this into perspective for non-traders, consider a busy marketplace. Market makers ensure the marketplace (exchange) is always bustling with buyers and sellers (uptime), there are enough goods for everyone (depth), and the prices of the goods are fair and competitive (spread).

Therefore, a project's choice of market maker can significantly impact its token's journey from pre-generation to cyclical growth. A committed market maker does not just assist in setting the stage but also helps the token navigate through changing market dynamics, acting as a steadfast ally from inception to maturity.

Four Phases of Token Pricing

Pre-Generation Construction: The journey of a token starts even before it hits the market. During the Pre-Generation Construction phase, projects materialize from mere ideas into solid businesses ready to enter the global digital economy. This phase involves creating business plans, assembling teams, developing technology, and securing funding.

Part of this preparatory stage also involves building strategic relationships with key industry players. Market makers, smart-contract auditors, exchange partners, and core contributors aren't just service providers; they are partners who ensure a smooth and successful token launch. In essence, this initial phase is all about laying a robust foundation for the token to flourish in subsequent stages.

Primary Listing: The Primary Listing stage is a pivotal moment in a token's life cycle. It's the moment when the token first goes public and becomes available for trading on exchanges. A common listing strategy includes issuers opting to list their token on one centralized exchange and one decentralized exchange to cater to the different trading preferences of market participants.

The choice and number of exchanges is a decision influenced by various factors like the macroeconomic climate, the standing of the project's treasury, and the strength of the relationships formed during the pre-generation construction phase. It's like setting the stage for a grand performance, choosing the right platform is crucial for the token's initial reception in the market.

The standard token economic structure often favors a low initial float in comparison to the token's valuation, which, under certain conditions, can lead to a substantial “pop” or price increase upon listing. The magnitude of this surge can vary across exchanges, chains, and projects and needs to be met with adequate liquidity supplied by market makers to ensure price discovery stays orderly. As market makers set up the primary market listing, they need to ensure they are adequately capitalized to place liquidity before the market opens.

Market makers generally prepare for significant volatility at this early stage of price discovery to ensure that the liquidity remains healthy irrespective of the token’s price trajectory. If liquidity isn't sufficient at this juncture, a listing might encounter issues.

Price Discovery and Expansion: Following the primary listing comes the Price Discovery and Expansion stage. Here, the token, usually facing large inflationary pressures, begins to find its 'true' market value. This phase is influenced by various factors including the token's inflationary aspects, prevailing market demand, and the depth of liquidity provided.

Market makers play a crucial role in this stage by ensuring that there is sufficient liquidity for smooth trading, which ultimately supports an efficient price discovery process.

Now, you might be wondering, “What constitutes 'efficient' price discovery?” Broadly speaking, efficient price discovery enables a market maker to leverage price volatility and expand liquidity provisioning through cyclical periods. Efficient price discovery does not mean that the price should move in any particular direction, but rather, it should reflect the "true" market value of the token. Liquidity is the key to ensuring that this happens.

Expansion, on the other hand, is about growing the project's reach and trading community. This could mean listing on more exchanges or bridging onto additional chains. Think of it as a plant growing its roots to absorb more nutrients; a token expands its presence to tap into more liquidity and trading opportunities.

Cyclical Growth Amid an End to Inflation: Finally, when a token achieves a certain level of maturity and its overwhelming inflationary period concludes, it allows for cyclical growth.

The token's price stabilizes, and growth becomes less about explosive leaps and more about steady, cyclical progress. It's not the end, but rather the beginning of a steady journey.

Here, the token begins to be influenced more by project-specific news, technological advancements, and overall market sentiment than by initial market hype. The complex dynamics of this phase are a subject unto themselves and will be discussed in greater detail in our upcoming articles.

A Sample Price Discovery

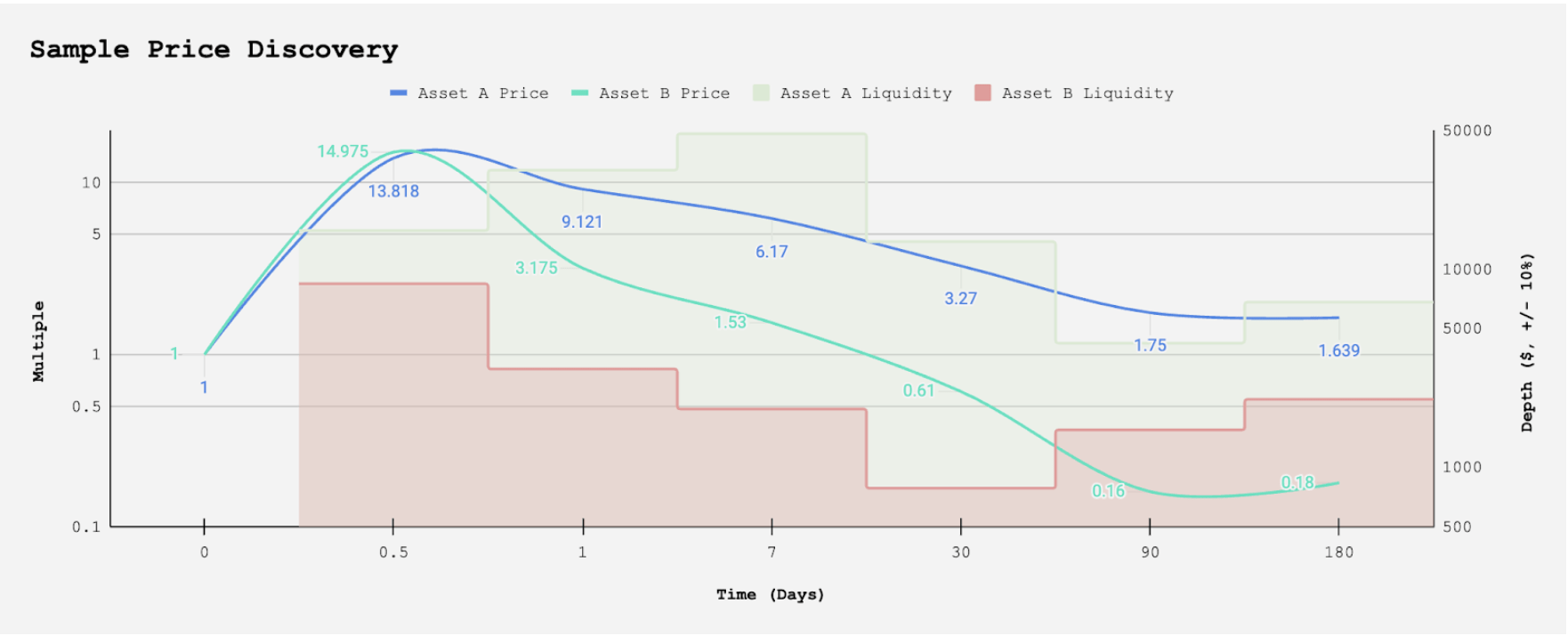

Examining the provided sampled data demonstrates the fundamental impact of liquidity on price discovery, particularly during periods of significant inflation. Both Assets A and B were launched simultaneously on the same exchange with similar funding and pre-market excitement, yet their subsequent trajectories diverged notably, primarily due to differences in liquidity.

In the first few days, both assets experienced initial price surges, a common occurrence in new listings. However, Asset A, enjoying superior liquidity, demonstrated a stronger and more stable price performance compared to Asset B. This relative stability of Asset A continued over the following weeks, while Asset B, with its consistently lower liquidity, witnessed sharper price drops. The contrasting price evolution of the two assets serves as a stark illustration of the importance of liquidity in fostering efficient price discovery.

As the 90-day mark approached, Asset A consistently maintained a healthier price performance relative to Asset B, bolstered by its robust liquidity levels. In a high inflation scenario, such as the one observed in the initial months, the substantial liquidity of Asset A acted as a shock absorber, mitigating price volatility and fostering a smoother price discovery process. These observations underscore the key role that market makers play in providing sufficient liquidity, particularly during the critical early stages of an asset's life cycle.

Conclusion

The intricate journey of a token, from its conceptualization to maturity, is fundamentally influenced by liquidity and the role market makers play in facilitating this liquidity. This journey, encompassing Pre-Generation Construction, Primary Listing, Price Discovery and Expansion, and finally, Cyclical Growth, reveals that an efficient and smooth progression at each stage hinges on maintaining robust liquidity.

Drawing parallels with our examination of Assets A and B, it is evident that superior liquidity can be a determining factor in the stability and health of a token's price performance. The pivotal role of market makers, thus, extends beyond mere facilitation of trade. They serve as the guardians of liquidity, ensuring a smooth, efficient, and orderly price discovery process for assets, safeguarding them from extreme volatility and ensuring they reflect their "true" market value. As the digital economy evolves, the expertise and strategies employed by market makers will remain indispensable in guiding tokens and assets to their rightful place in the market.

THE CONTENT ON THIS WEBSITE IS NOT FINANCIAL ADVICE

The information provided on this website is for information purposes only and does not constitute investment advice with respect to any assets, including but not being limited to, commodities and digital assets. This website and its contents are not directed to, or intended, in any way, for distribution to or use by, any person or entity resident in any country or jurisdiction where such distribution, publication, availability or use would be contrary to local laws or regulations. Certain legal restrictions or considerations may apply to you, and you are advised to consult with your legal, tax and other professional advisors prior to contracting with us.