Market Update Summary - Aug 29

Major Token Performance Performance

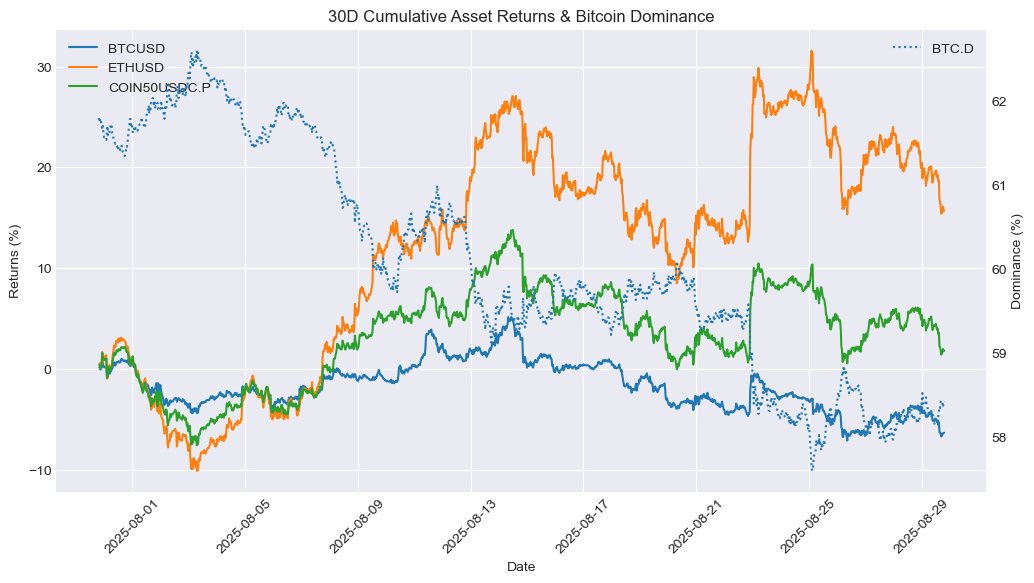

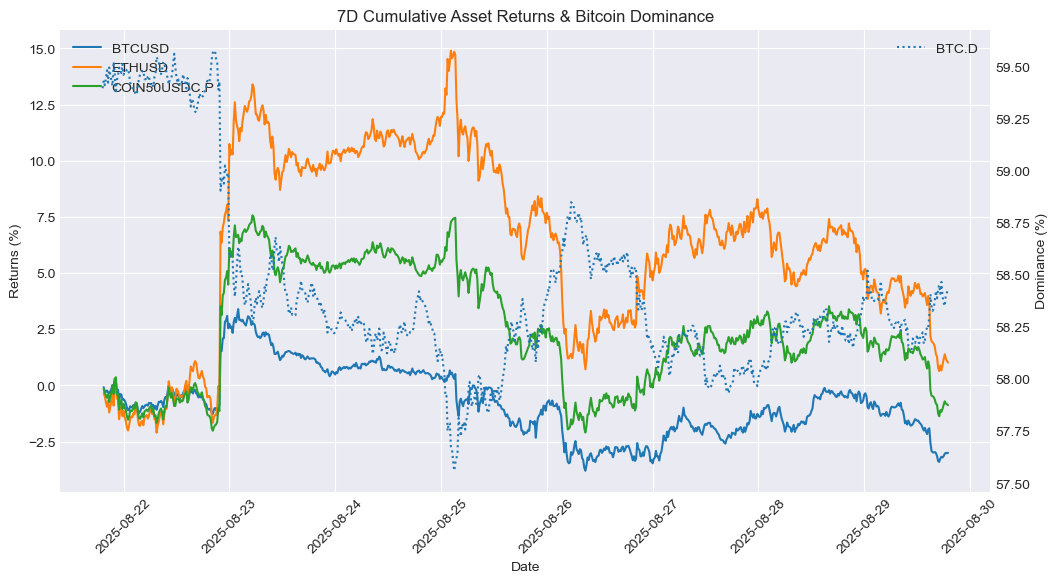

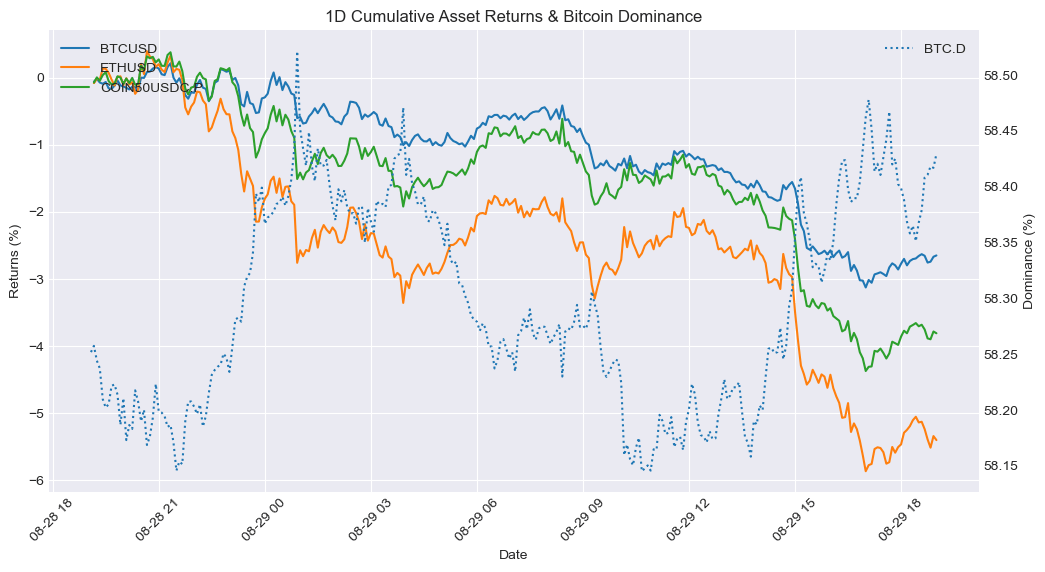

How to Read These Charts

These charts show the cumulative price returns of Bitcoin (BTC), Ethereum ETH), and the COIN50 index over the selected period — 30 days, 7 days or 24 hours. Returns are rebased to 0% at the start of each period to highlight relative performance trends between assets.

The BTC dominance line (secondary axis) tracks Bitcoin’s share of the total crypto market capitalization, offering context on capital rotation between BTC and altcoins. Rising BTC dominance typically indicates capital consolidation into Bitcoin, while a decline suggests increased risk appetite and flows into altcoins.

Use these charts to quickly assess:

Which assets outperformed or underperformed over the period

Whether market strength was concentrated (BTC-led) or broad-based

How shifts in BTC dominance align with overall performance trends

Asset | 30D Change | 7D Change | 1D Change | Price |

BTCUSD | -6.35% | -3.00% | -2.68% | 110031.92 |

ETHUSD | 15.68% | 1.04% | -5.45% | 4344.87 |

XRPUSD | -5.69% | -1.20% | -4.18% | 2.8778 |

BNBUSD | 8.57% | 0.34% | -1.62% | 856.3 |

SOLUSD | 16.97% | 12.21% | -2.67% | 207.21 |

COIN50USDC.P | 1.78% | -0.93% | -3.86% | 505.93 |

XAUUSD | 2.23% | 2.23% | 0.25% | 3405.33 |

SPX | 1.95% | 2.01% | 0.15% | 6501.85 |

How to Read This Table

This table summarizes the percentage price change of key crypto and macro assets over three timeframes: 30 days, 7 days, and 24 hours. It includes major cryptocurrencies (e.g., BTC, ETH, XRP, SOL), a benchmark altcoin index (COIN50), and traditional market comparables like gold (XAU) and the S&P 500 (SPX).

The data allows you to:

Compare short-term and medium-term performance across sectors

Spot momentum leaders and laggards in both crypto and traditional markets

Assess whether market moves were broad-based or asset-specific

Track how crypto assets performed relative to macro benchmarks

This table provides a concise view of market dynamics across different asset classes and helps contextualize crypto performance within a broader macro landscape.

Newly Listed Projects

As of 2025-08-15 1:00PM

Projects and Exchanges

Project | Symbol | Exchange(s) | Listing Date |

Camp Network | CAMP | Bybit | 2025-08-27 |

Price Performance

Symbol | Opening Price | Current Price | 24 hour Change | All-Time High | All-Time Low | Current Multiple from Open | ATH Multiple from Open |

CAMP | $0.02 | $0.09504 | 8.4% | $0.32015 | $0.02 | 4.75x | 16.01x |

Liquidity Performance

Symbol | Spread | +2% Depth | -2% Depth | 24 Hour Volume |

CAMP | 0.04% | $71,676 | $93,678 | $13,115,455 |

Smart Money Flows

Top 10 7D Flows

Asset | Chain | 30D Flow | 7D Flow | 24H Flow | Market Cap |

SOL | solana | 16.67M | 9.56M | -267.47K | 84.17B |

FLIPR | solana | 137.75K | 94.51K | 45.34K | 9.10M |

PCULE | solana | 159.45K | 85.68K | - | 7.71M |

JLP | solana | 31.29K | 79.98K | - | 1.94B |

LAUNCHCOIN | solana | 72.78K | 70.54K | 10.00K | 67.01M |

TOKABU | solana | -159.71K | 67.00K | -28.26K | 36.02M |

JUP | solana | 236.50K | 58.67K | - | 1.57B |

CUPSEY | solana | 43.44K | 56.07K | 40.85K | 3.64M |

CLANKER | solana | -16.18K | 49.09K | -1.79K | 7.29M |

67 | solana | -112.90K | 40.84K | 47.06K | 5.74M |

Bottom 10 7D Flows

Asset | Chain | 30D Flow | 7D Flow | 24H Flow | Market Cap |

LLM | solana | -181.68K | -181.68K | 19.71 | 3.21M |

USDUC | solana | -172.66K | -141.05K | -3.88K | 41.46M |

YZY | solana | -371.72K | -101.58K | - | 69.11M |

LIGHT | solana | -792.43K | -85.65K | 20.99K | 27.11M |

DOLLO | solana | -311.76K | -84.18K | -26.45K | 5.13M |

WED PEPE | solana | -79.56K | -79.56K | -79.56K | 4.10M |

SPX | solana | -233.62K | -75.14K | -33.69K | 1.05B |

PENGU | solana | -422.25K | -73.67K | -73.66K | 1.83B |

JITOSOL | solana | 115.74K | -63.71K | -51.78K | 3.14B |

OUTLIER | solana | -59.40K | -59.40K | 1.70K | 480.05K |

These tables track the weekly movement of "smart money" wallets across various tokens and chains.

The Top 10 7D Flows table highlights assets that have seen the largest net inflows from smart money in the past 7 days. A high and rising 7D flow suggests growing interest, accumulation, or conviction by sophisticated traders, and may indicate strong underlying narratives or catalysts. Compare these flows with the token’s market cap to assess relative impact, inflows into small-cap assets are generally more price-sensitive.

Conversely, the Bottom 10 7D Flows table shows tokens with the largest net outflows from smart money wallets. Persistent or large outflows may reflect profit-taking, loss-cutting, or reduced confidence, and can signal weakening sentiment or fading momentum. Watch for sustained outflows alongside declining price or on-chain activity.

Use these tables to:

Identify tokens where smart money is actively positioning

Spot emerging narratives or sentiment reversals

Gauge chain-specific flows, e.g., Solana vs. Ethereum vs. Base

Inform rotational strategies across high-alpha tokens

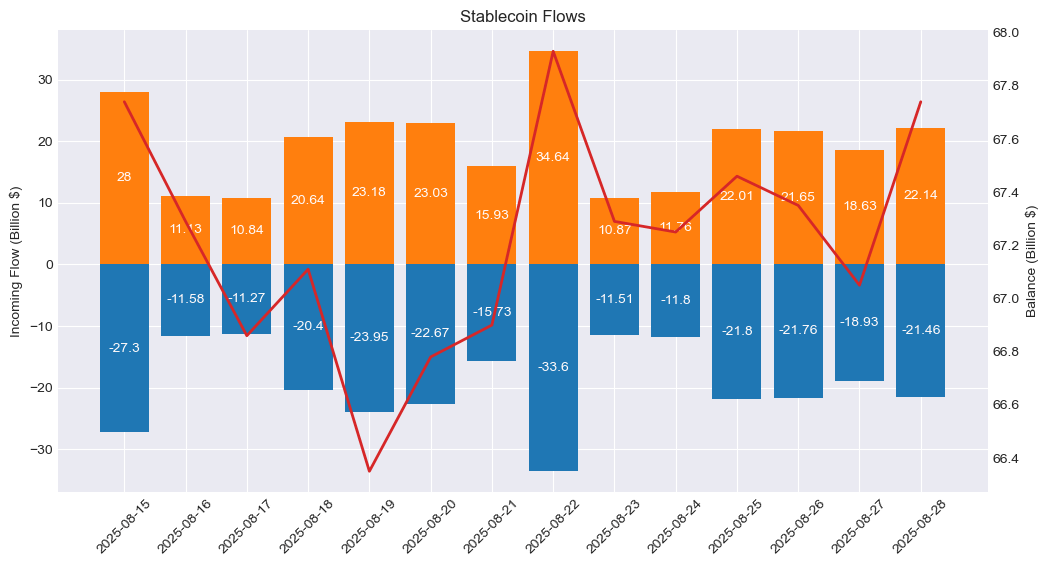

Stablecoin Flows

Stablecoin flow data provides a real-time pulse of capital movement across exchanges and chains.

Rising stablecoin balances on-chain or on exchanges often indicate inbound liquidity, capital sitting on the sidelines potentially awaiting deployment into crypto assets. Large inflows may precede buying activity, suggesting growing market participation or renewed confidence.

On the other hand, net outflows of stablecoins could imply that capital is either exiting the crypto ecosystem or being actively deployed into volatile tokens, especially when accompanied by declining exchange balances or stablecoin dominance.

Use stablecoin flows to:

Detect early signs of market risk appetite

Monitor capital rotation between stablecoins and volatile assets

Confirm the sustainability of rallies (is money really coming in?)

Support broader macro or positioning views from other data (e.g., smart money behavior or BTC dominance)

Macro & Crypto News

August 28: Google Pushes Forward With Layer-1 Blockchain Built for Finance

Google Cloud is making strides with its upcoming Layer-1 blockchain, Universal Ledger (GCUL), first unveiled in March alongside CME Group. Designed specifically for financial applications, GCUL will support Python-based smart contracts and aims to offer a neutral platform—positioning itself as an alternative to fintech-led chains like those from Stripe and Circle. CME Group has already completed integration testing, with wider market trials expected ahead of a planned 2026 launch.

August 27: Crypto Lobbyists Demand Developer Protections in Senate Bill, Threaten Withdrawal of Support

U.S. crypto lobbyists are warning lawmakers that without explicit protections for software developers in the upcoming market structure legislation, the industry will withhold its support. While the Clarity Act includes such safeguards, there is growing concern they may be excluded from the Senate’s version of the bill. Over 100 companies and advocacy groups—forming what’s being called the largest crypto lobbying coalition in history—have signed a letter urging senators to preserve these provisions or risk losing the industry’s backing altogether.

August 25: Gemini Launches XRP Rewards Card, Boosts RLUSD Trading for U.S. Customers

Gemini has introduced a new XRP-branded credit card in partnership with Ripple, offering up to 4% crypto rewards on purchases. Issued by WebBank, the card provides 4% back in XRP for fuel, EV charging, and rideshares; 3% on dining; 2% on groceries; and 1% on other spending. Select merchants will also offer up to 10% cashback in XRP. Simultaneously, Gemini is expanding support for Ripple’s RLUSD stablecoin as a base currency for spot trading pairs in the U.S., as part of its broader push ahead of a planned IPO.

August 25: Japan’s Finance Minister Endorses Crypto as Part of Diversified Investment Strategy

Japanese Finance Minister Katsunobu Katō acknowledged that, despite their volatility, crypto assets can play a role in a diversified investment portfolio. His comments reflect a broader government stance favoring innovation in the digital asset space, while avoiding overly restrictive regulation. Katō’s remarks come as Japan grapples with a high debt-to-GDP ratio and rising concerns over potential financial repression and yen devaluation.

THE CONTENT ON THIS WEBSITE IS NOT FINANCIAL ADVICE

The information provided on this website is for information purposes only and does not constitute investment advice with respect to any assets, including but not being limited to, commodities and digital assets. This website and its contents are not directed to, or intended, in any way, for distribution to or use by, any person or entity resident in any country or jurisdiction where such distribution, publication, availability or use would be contrary to local laws or regulations. Certain legal restrictions or considerations may apply to you, and you are advised to consult with your legal, tax and other professional advisors prior to contracting with us.