Analyzing Cryptocurrency Primary Listing Performance in 2023 (Updated July 6, 2023)

Introduction:

We believe that a token’s primary listing is one of the most important events in a project’s history. For most tokens, this event will bring in the highest organic volumes and establishes the groundwork for subsequent price discovery.

In this blog post, we will analyze the performance of tokens listed on different exchanges, both centralized and decentralized, through July 6, 2023. By leveraging data taken from these exchanges and other publicly available information, we will analyze the effectiveness and success of each exchange. We will focus on key metrics such as the number of qualified listings, winners, losers, average ATH (All-Time High) multiples, and other time-related multiples. This analysis aims to provide valuable insights into the performance of tokens on specific exchanges.

Following this analysis, we will outline our expectations for the industry in the near future as it pertains to the exchange landscape.

Before we begin to look at the data, please keep in mind that this list is not exhaustive and does not include all primary listings for 2023.

Key Notes:

There are few key distinctions to be made before we take a deeper dive into the data.

One of the more important is qualified listings. When debating whether or not we should track a listing, we consider launch venue, key investors, project quality, funding amount, launchpad venue, and social interaction. If a baseline number is reached among all of these variables then we will track the listing.

The majority of this data is sourced from cryptorank.io to which we found funding and launch information. A minimum of $250,000 must have been raised to be considered. However, not all launches had easily accessible funding amounts to which we relied heavily on the other factors listed above.

The second distinction is that primary token listings can occur on multiple platforms simultaneously. For example, a particularly common primary listing play for the past few months has been the trio of KuCoin, Gate.io, and ByBit. This occurred at least 11 times in the 78 qualified listings that we tracked since the beginning of the year. As a rule of thumb, we typically attribute the listing to the venue that is most publicized by the issuer.

The third distinction is the qualification of success or failure of a listing. To determine a winner or a loser, we compare a listing’s performance to the Adjusted 2023 Multiples. If a listing’s multiple reaches 75% of the Adjusted 2023 ATH while settling above at least 33% of its own ATH then it is determined a winner. If it fails this criteria then it is determined a loser. The goal here is to extract premarket order biases and reward listings who supply quote liquidity at relatively reasonable price levels.

Lastly, there, unfortunately, exists inorganic trading behaviors at play on almost all of these trading platforms and it is nearly impossible to extract these from the data set. For this reason, we do not value volumes when determining launch success.

What’s New?

Over the past month, we have incorporated 52 new listings, with 31 additions occurring in June and 5 in July so far. These new data points have introduced several new exchanges, including Ascendex, OPNX, and Trader Joe. Additionally, we have streamlined our approach by consolidating all versions of decentralized exchanges (DEXs) into their respective parent DEX, reducing complexity and improving efficiency. For example, Uniswap V3, Uniswap V2, and Uniswap on Arbitrum are now unified as a single entry under Uniswap.

In line with our commitment to comprehensive data collection, we have expanded our tracking beyond the initial 24-hour period. We now gather data over 7 days, 30 days, and 90 days for each exchange. This extension allows us to assess trading pairs' organic liquidity and penalize those that do not demonstrate sufficient trading efficiency. With the collected data, we have developed a proprietary scoring system that enables us to rank exchanges. It is important to note that these rankings should not be interpreted as a recommendation to favor one exchange over another or as a reflection of our internal perception of these exchanges.

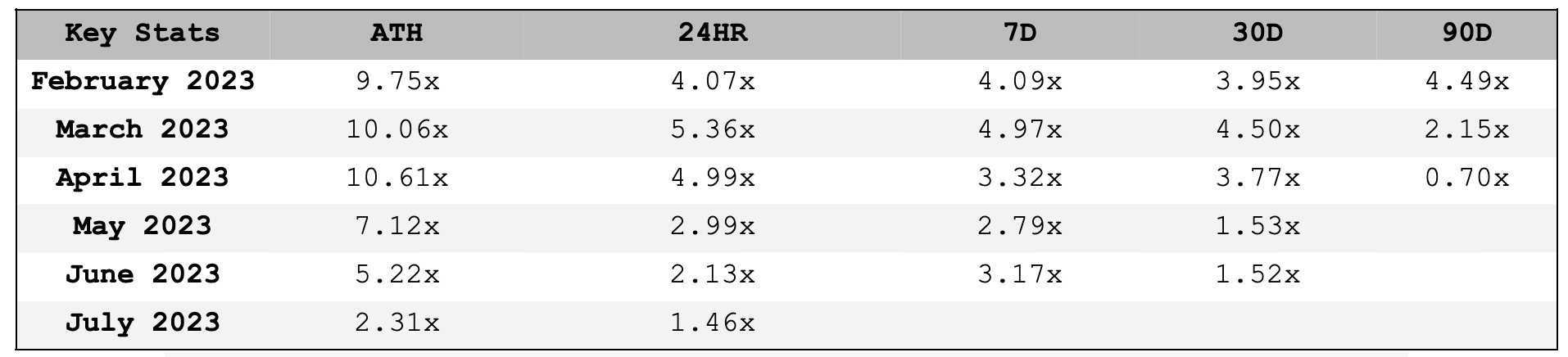

Moreover, we are pleased to announce that we will now provide performance data for listings over time. This information will illustrate the market's strength and highlight the impact of positive and negative narratives on the relative success of listings.

We remain dedicated to delivering accurate and insightful data to support your informed decision-making. Should you have any questions or require further assistance, please do not hesitate to reach out to our team.

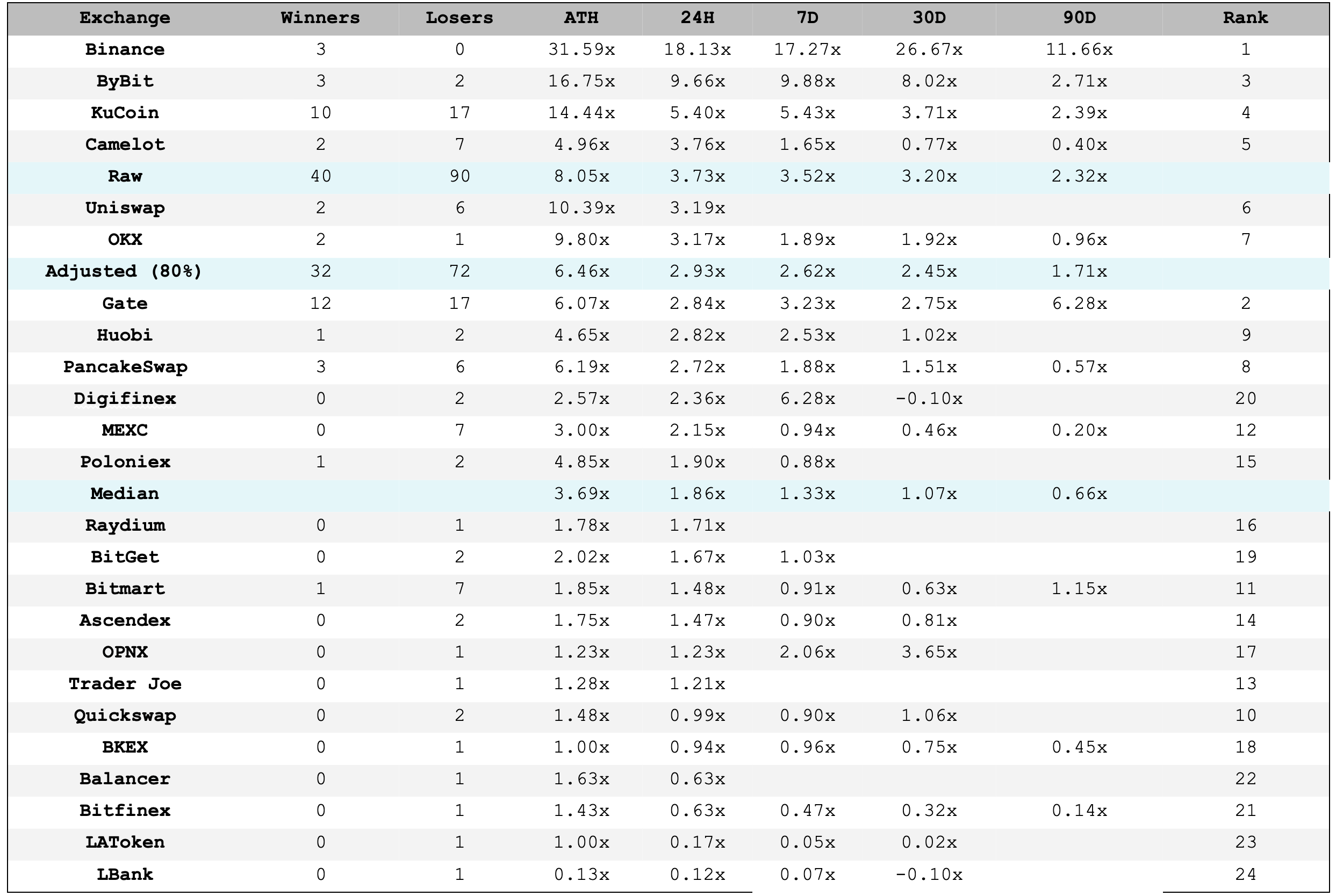

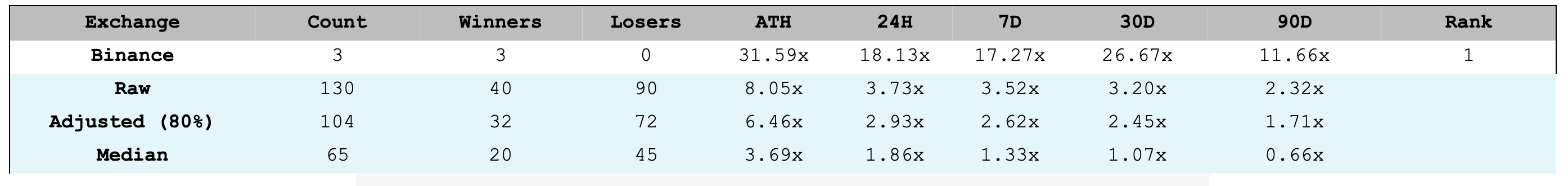

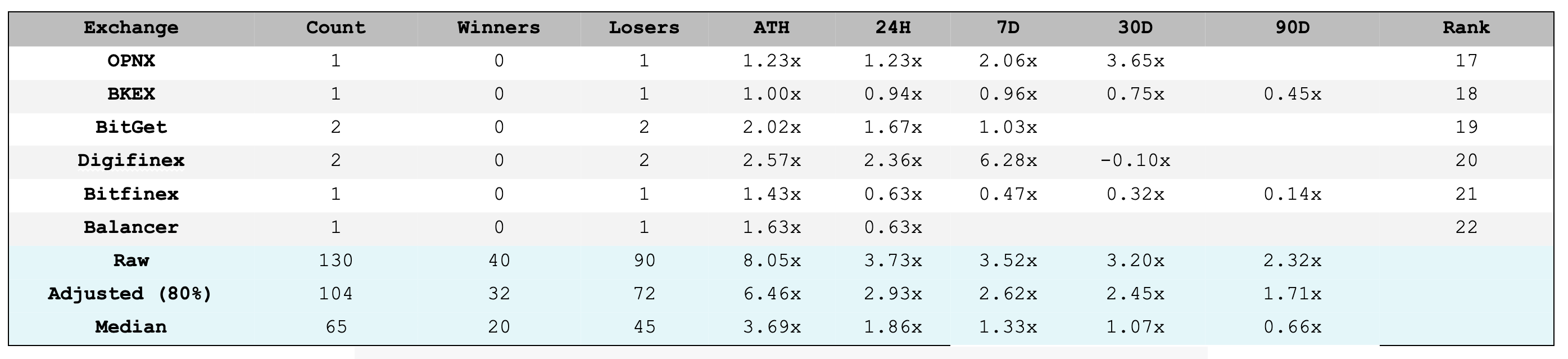

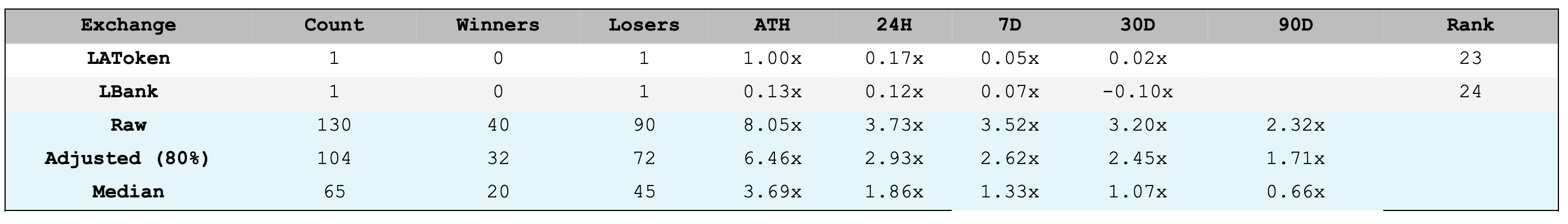

Unfiltered Data - Jan 2023 to July 6, 2023

Table Notes:

ATH - All time high multiple typically within the first 24 hours of a primary listing

24 hr multiple - The price multiple at the 24 hr close

7 d multiple - The price multiple at the 7 day close

30 d multiple - The price multiple at the 30 day close

90 d multiple - The price multiple at the 90 day close

Rank - The rank of exchange according to our proprietary scoring system

Winners - Qualified listings which achieve ATH multiples greater than 75% of the Adjusted 2023 ATH with prices settling above 33% of the ATH after 24hrs

Losers - Qualified listings which do not fulfill the above criteria

Discussion:

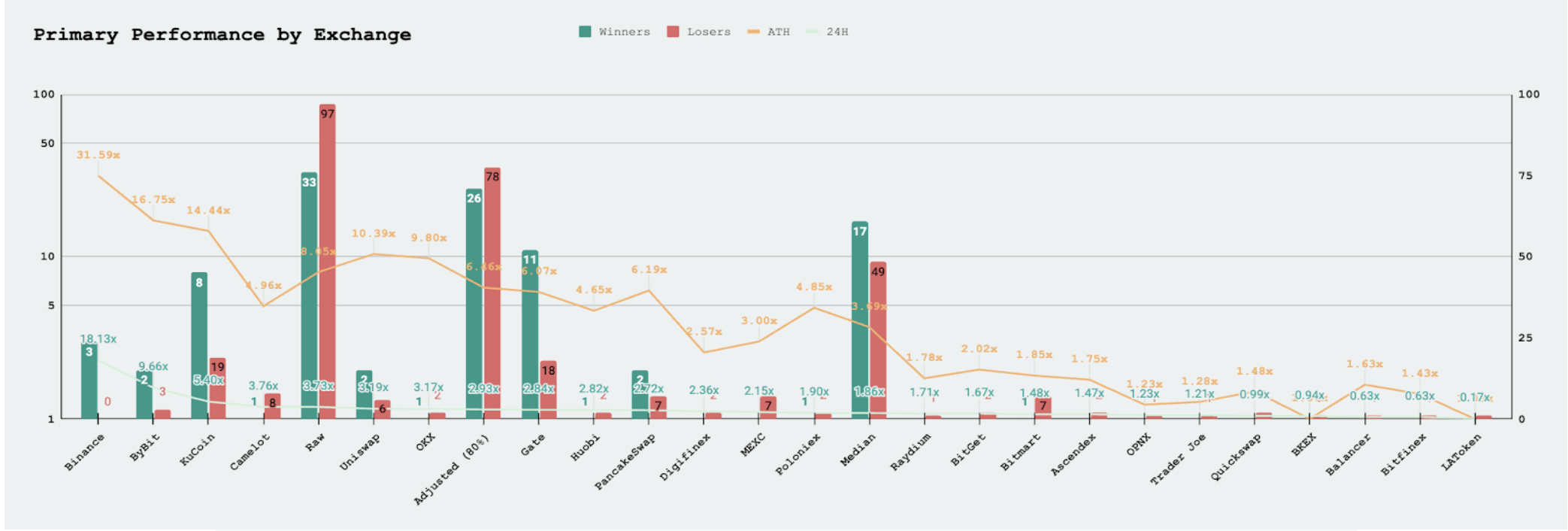

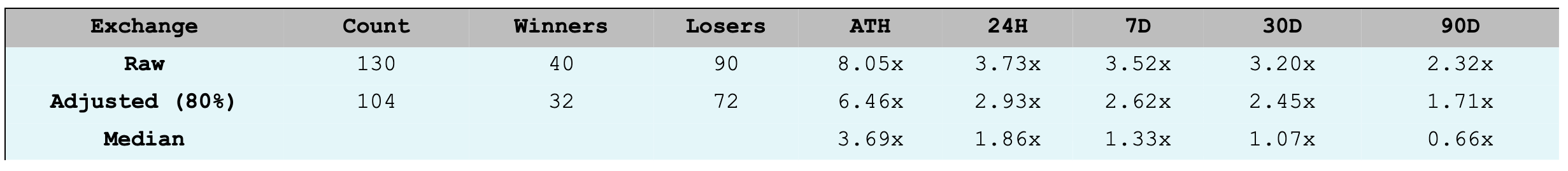

Through 2023, we have found 130 qualified listings of which 40 were determined winners and 90 were determined to be losers. Thus, only 30.7% (-1.3%) of qualified listings could be considered winners. This is an extremely small subset of listings to start the year. The average ATH multiple across these listings was 8.05x (-3.53x) while the average 24 hour multiple closed at 3.73x (-1.22x). Furthermore, the price curve of assets averages 3.52x after a week, 3.2x after a month, and 2.32x after 90 days. This is expected as inflation occurs.

However, not all winners and losers are equal. For that reason, the Adjusted 2023 line trims the data set to ignore the upper and lower 10% of listings. By shrinking the data set, the average ATH lowers to 6.46x (-3.14x) and the 24 hr multiple to 2.93x (-1.24x).

On the other hand, we have observed a notable disparity between the median performing asset ATH multiple of 3.69x and its 24-hour multiple of 1.86x against adjusted averages. This inconsistency can be attributed to several factors, including the concentration of success among a select number of listings, limited organic demand, and poor liquidity, which is evident from the median price curve.

These numbers can be used as a baseline for comparison across venues but should not be considered as an expectation for a future listing. The structure of a premarket listing can vastly alter how a listing performs along with a laundry list of additional dynamic, ever-changing factors.

Overall, the analysis of price multiples and associated narratives highlights the significant influence of market sentiment on exchange listings. Positive narratives have historically driven higher price multiples, while negative narratives have had a dampening effect on market performance. It is crucial for market participants to carefully monitor and assess these narratives to make informed decisions.

Through February 2023, the market experienced a significant rebound following a dormant December 2022. This was accompanied by impressive price multiples, with an all-time high (ATH) multiple of 9.75x and a strong 24-hour multiple of 4.07x. Throughout March 2023, the positive sentiment continued due to rumors of Asian market reopenings and the Arbitrum Airdrop, resulting in further price growth and higher multiples across various timeframes.

By April 2023, a noticeable shift occurred as bearish narratives began to outweigh bullish narratives, marking an inflection point in market sentiment. This period witnessed a stall in price multiples, indicating a growing negative sentiment and decreased market enthusiasm. The price multiples topped at 10.61x (ATH), 4.99x (24HR), and 3.32x (7D), reflecting the impact of the increasing bearish narratives on market performance. In May 2023, the negative sentiment persisted as the price multiples further decreased, reaching 7.12x (ATH) and 2.99x (24HR. This decline can be attributed to regulatory concerns and market uncertainty, impacting the overall market performance.

June 2023 saw a continuation of the negative narratives with the SEC complaints affecting major exchanges and rumors surrounding Gate's solvency. This resulted in a further decrease in price multiples, with 5.22x (ATH) and 2.13x (24HR). The market also faced regulatory risks during this period.

As we move into July 2023, the price multiples have continued to decline, suggesting a persistently negative sentiment. However, it is worth noting that the data for July is incomplete and requires further analysis to draw definitive conclusions.

Class A:

Binance retains its position as the top exchange even with regulatory uncertainty. With three qualified listings, Binance’s organic flow is unparalleled in comparison to the other exchanges discussed in this analysis leading them to be in a class of their own. Furthermore, Binance’s price curve through 90 days far outpaces its competitors.

Once again, please keep in mind that this list is not exhaustive. Exchanges like Coinbase, a premier exchange, did not have a qualified listing.

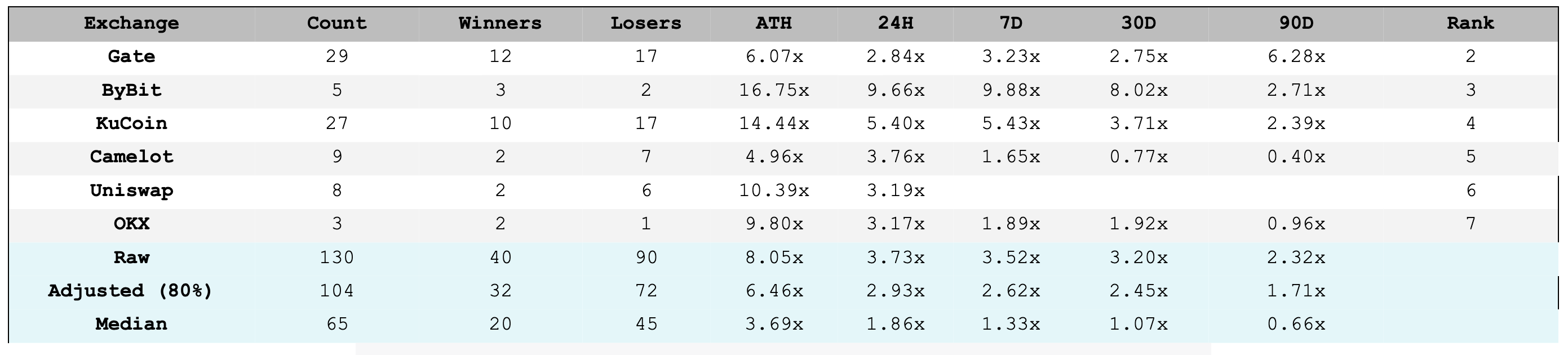

Class B:

Stepping out from the pack, stands Gate. Although their short-term multiples (ATH and 24H) may be lower than other exchanges, their focus on promoting healthy market dynamics is reflected in their strong long-term performance (7D, 30D, and 90D). With a winning rate of 41%, Gate surpasses the average by 10.3 percentage points, highlighting their success.

ByBit and KuCoin continue to demonstrate resilience despite declining user bases. While their positions in Class B are secure for now, a potential decline in standing may occur as organic volumes decrease over time.

Uniswap emerges as a winner amidst regulatory uncertainty, solidifying its status as the premier decentralized exchange for token launches. Our internal data indicates that DEX volumes are capturing an increasing market share, further establishing Uniswap's prominence.

Camelot, a Uniswap V2 clone on Arbitrum, capitalized on the positive narrative surrounding Arbitrum earlier in the year, leading to a series of successful listings on this optimistic layer two solution. Although the Arbitrum hype has waned, Camelot's recent listings have propelled it into Class B.

OKX, following a similar path to Binance, has been selective in token listings. Despite their infrequent listings, their success rate has been notable, with two out of three listings outperforming industry averages in terms of short-term multiples.

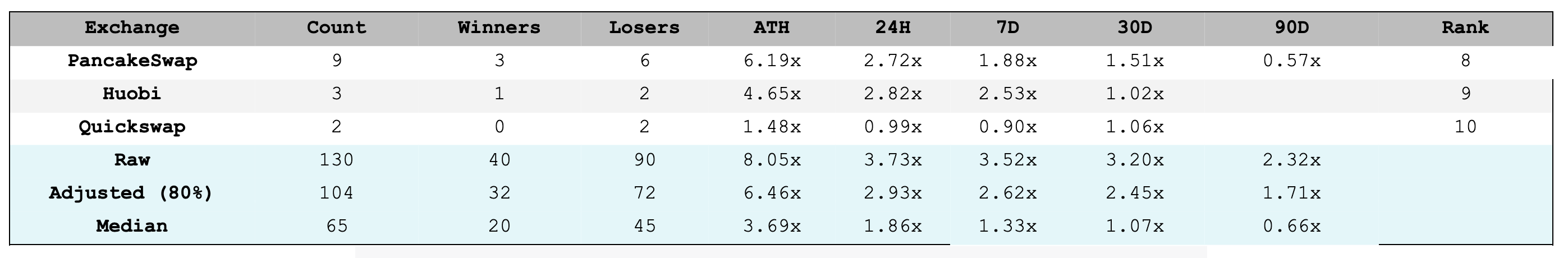

Class C:

PancakeSwap has shown a mixed performance. While they have three winners, the majority of their listings have experienced losses. Their all-time high (ATH) multiple of 6.19x and 24-hour multiple of 2.72x demonstrate some positive market response, but the relatively lower 7-day, 30-day, and 90-day multiples suggest challenges in sustaining long-term growth.

Huobi has had a moderate performance under the new regime. While one listing achieved success, the remaining two resulted in losses. Huobi's ATH multiple of 4.65x and 24-hour multiple of 2.82x indicate some positive market engagement, but the 7-day and 30-day multiples are relatively lower, reflecting a decline in momentum.

On the other hand, Quickswap has faced challenges as both listings resulted in losses. While Quickswap’s Polygon TVL is still higher than Uniswap’s (114m versus 90m), recent trends suggest that it will lose its title as the primary Polygon decentralized exchange.

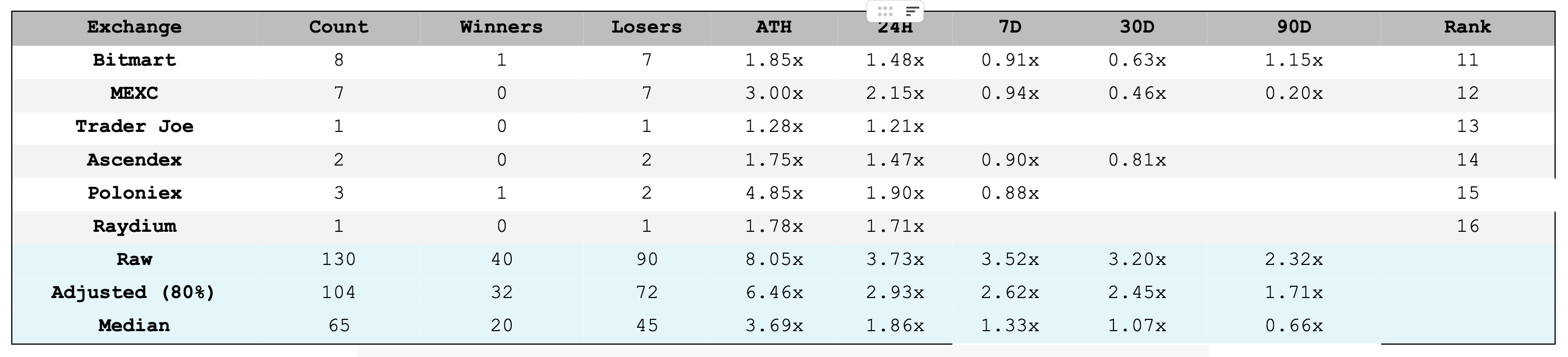

Class D:

Bitmart's performance has been inconsistent, with positive market response initially reflected in their ATH multiple of 1.85x and 24-hour multiple of 1.48x. However, the lower 7-day, 30-day, and 90-day multiples indicate challenges in sustaining long-term growth and generating organic demand, suggesting poor liquidity and limited market interest negatively impacting their price multiples.

Like Bitmart, MEXC has faced difficulties, with all of their listings resulting in losses. Despite a promising ATH multiple of 3.00x and 24-hour multiple of 2.15x, the subsequent decline in multiples across different timeframes further emphasizes the negative impact of poor liquidity and market demand on long-term price multiples.

Trader Joe, Ascendex, and Raydium had a limited number of listings, and unfortunately, all of their listings resulted in losses. Raydium and Trader Joe have struggled in comparison to other decentralized exchanges (DEXs), primarily due to the declining usage on their native blockchains, Solana and Avalanche, throughout 2023. However, it is worth noting that Trader Joe has made significant improvements in its non-Avalanche capabilities, and Solana has only recently started benefiting from liquid staking, which may present future opportunities for growth and recovery.

Poloniex stands out with a more balanced performance, with one successful listing and two losses. Their ATH multiple of 4.85x and 24-hour multiple of 1.90x demonstrate positive market engagement, but the lower 7-day and 30-day multiples suggest challenges in sustaining momentum and attracting consistent trading activity.

Class E:

While underperforming relative to industry average, OPNX and Balancer show signs of potential upside. OPNX’s approach to providing liquidity and investor relations is quite refreshing relative to its centralized exchange counterparts and Balancer’s 80/20 pool allows projects to go to market in difficult raising conditions.

However, the overall performance of other centralized exchanges, including BKEX, BitGet, Digifinex, and Bitfinex, has been challenging, as all of their listings resulted in losses. Despite initial positive ATH multiples, the subsequent decline in multiples across different timeframes reveals the difficulties in sustaining market interest and generating positive returns for these exchanges.

Class F:

LAToken and LBank have encountered challenges with both listings resulting in losses. The low ATH multiples of 1.00x and 0.13x indicate limited initial market engagement, and the subsequent decline in multiples across different timeframes reflects the difficulties in generating sustained interest and positive returns.

What’s Next?

Our thinking month by month has remained constant. There exists an abundance of headwinds in the industry currently. Narratives continue to impact liquidity conditions and market demand influencing price performance. We expect to see the following themes prevail throughout the remainder of the year and beyond:

Consolidation of Centralized Exchanges

Expect to see considerable consolidation of centralized exchanges through 2024. Our findings show that the majority of success for primary listings occur on a few select exchanges. This is due to lower retail demand, regulatory pressures, and blatant mismanagement of centralized exchanges.

Decentralized Exchanges Growth Driven by Narratives

The non-custodial nature and ease of access for decentralized exchanges allows user traffic to be nimble and adjust quickly to economic conditions. This can be evidenced by the success of Uniswap earlier in the year as retail and institutions pushed away from centralized exchanges post-FTX collapse and the addition of Camelot as an ideal launch venue through the Arbitrum craze in Q1 2023.

We expect this trend to continue through the current market cycle as centralized order flow lessens and centralized risk persists.

Opportunities for New Entrants: Hybrid Exchanges

We see the opportunity for Hybrid Exchanges to gain a significant market share over the next few years as the existing centralized exchange structure weakens. These “Hybrid” Exchanges feature the comfort of a central limit order book commonly found on centralized exchanges coupled with the non-custodial features of a decentralized exchange.

There have been considerable developments in the space currently led by DyDx,1inch’s RFQ system, IDEX’s new derivatives exchange and other venture backed companies coming to market.

Conclusion:

Analyzing the primary listing performance of tokens listed on different exchanges in 2023 provides valuable insights into market trends and dynamics. Exchanges such as Binance and Gate have shown outperformance relative to the market, while a growing number of exchanges struggle.

An AI-Generated Summary:

The primary listing of a cryptocurrency token is a crucial moment, as it brings in high volumes and starts price discovery.

The article introduces 52 new listings, providing fresh data points and including exchanges like Ascendex, OPNX, and Trader Joe.

A proprietary scoring system is implemented to rank exchanges based on their performance.

The importance of considering longer-term multiples and liquidity is emphasized to gain a comprehensive understanding of token performance beyond the initial listing period.

The impact of positive and negative narratives on the relative success of token listings is explored, illustrating how market sentiment can influence performance.

The article highlights the potential for consolidation among centralized exchanges, growth of decentralized exchanges driven by narratives, and opportunities for hybrid exchanges in the future.

Contact:

If you are interested in this information and would like to discuss more, please feel free to reach out through our contact form.

THE CONTENT ON THIS WEBSITE IS NOT FINANCIAL ADVICE

The information provided on this website is for information purposes only and does not constitute investment advice with respect to any assets, including but not being limited to, commodities and digital assets. This website and its contents are not directed to, or intended, in any way, for distribution to or use by, any person or entity resident in any country or jurisdiction where such distribution, publication, availability or use would be contrary to local laws or regulations. Certain legal restrictions or considerations may apply to you, and you are advised to consult with your legal, tax and other professional advisors prior to contracting with us.